ValOre Reports High-Grade Platinum and Palladium from Trado® Auger and Rock Assays at Boa Vista Target, Pedra Branca PGE Project, Brazil

Vancouver, British Columbia, October 15, 2024 - ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTCQB: KVLQF; Frankfurt: KEQ0, “the Company”) today provided assay results from Trado® auger and rock samples collected from the Boa Vista target (“Boa Vista”) at ValOre’s 100%-owned Pedra Branca Platinum Group Elements (“PGE”, “2PGE+Au”) Project (“Pedra Branca”) in northeastern Brazil.

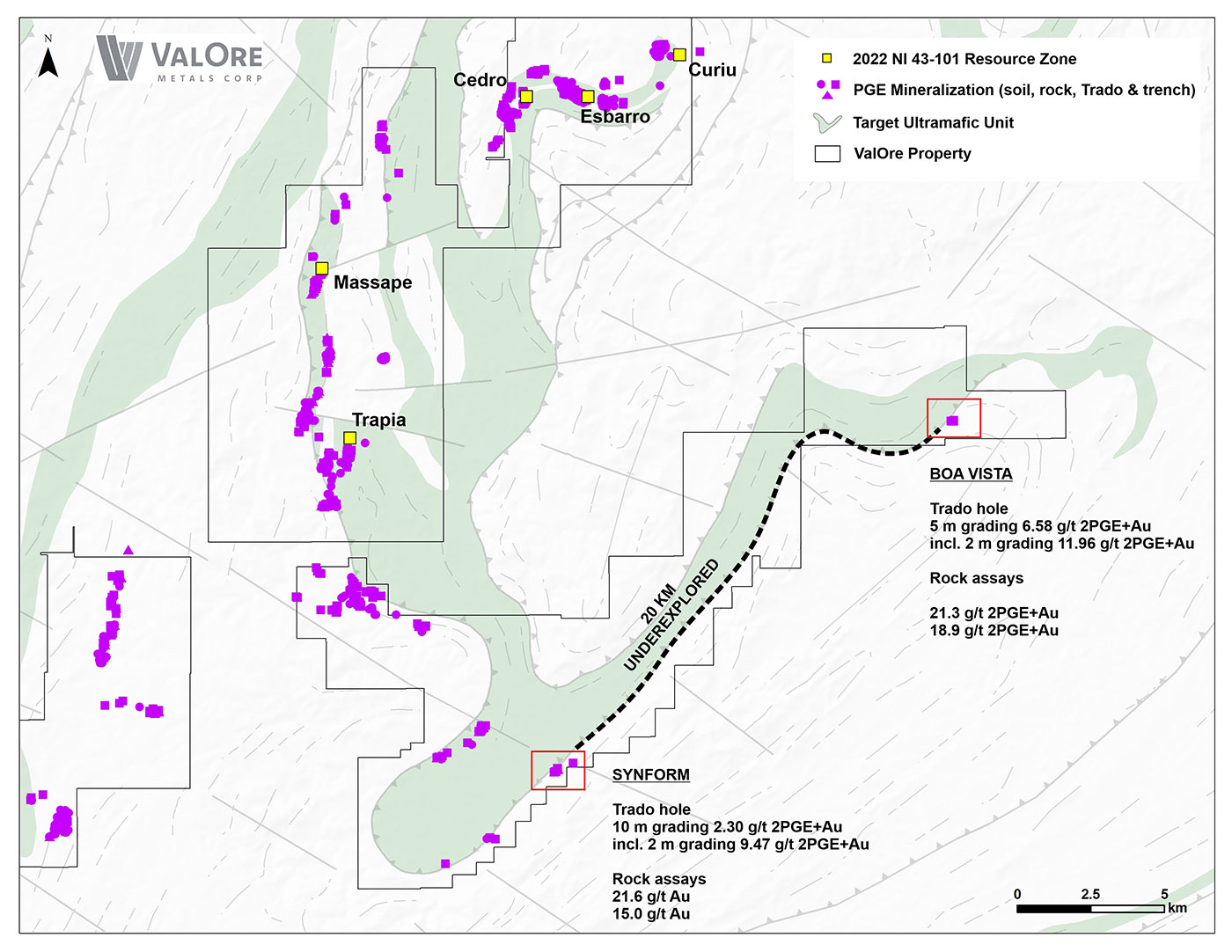

“The PGE mineralization reported today from the Boa Vista target includes numerous high grade rock samples and the best Trado® hole, on a gram / metre basis, ever drilled on the Pedra Branca property,” stated ValOre’s VP of Exploration, Thiago Diniz. “Boa Vista is located along the same geological trend as the Synform target, which also returned high-grade PGE mineralization in previous exploration programs. Follow up mapping and Trado® drilling is planned as part of a broader exploration program, utilizing the VRIFY AI tool, to be focused on potential targets along the 20km-long Boa Vista-Synform trend.”

2024 Boa Vista Exploration Program Highlights

Trado® Auger PGE Results

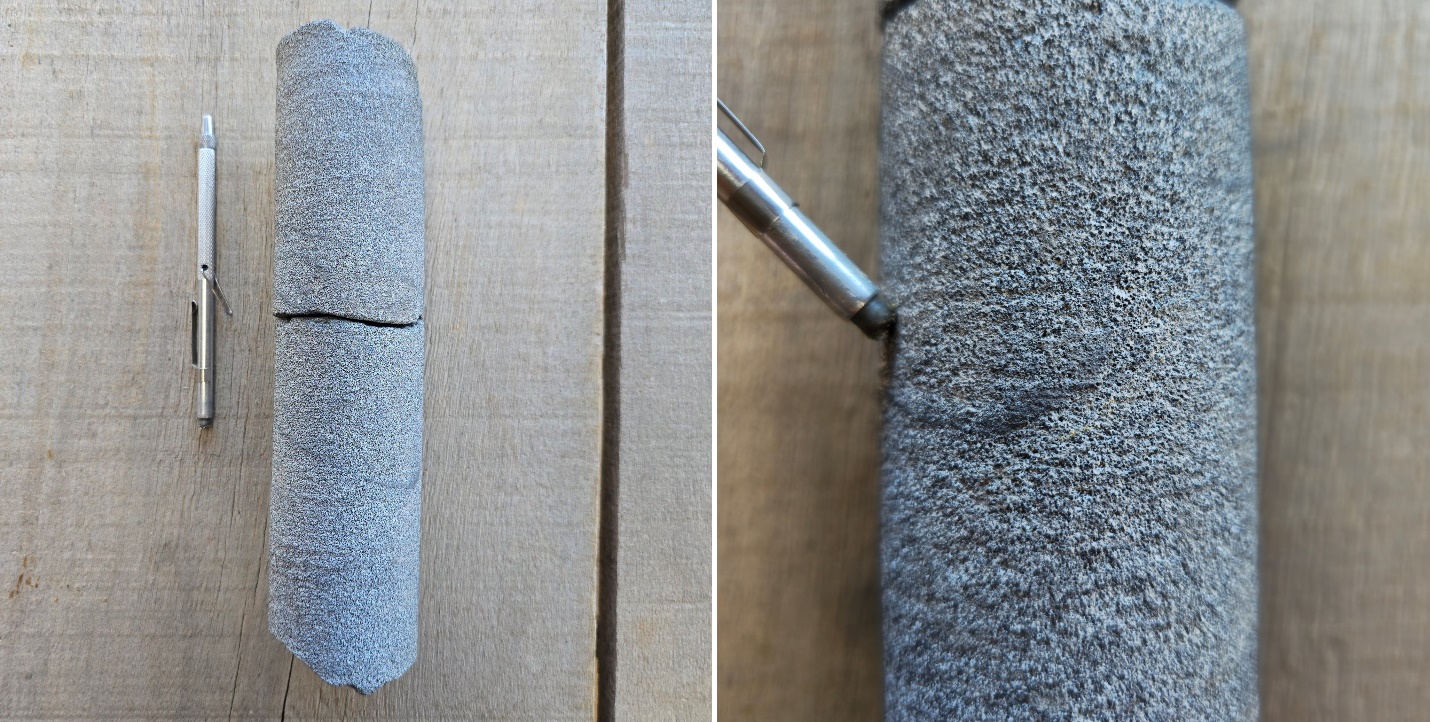

Trado® auger drilling has intercepted ultramafic rocks in 4 of 8 Trado® auger drill holes completed to date (18 m of 26 m drilled in total). All 3 Trado® assays received to date returned PGE mineralization, including:

- 5 metres (“m”) grading 6.58 grams per tonne palladium + platinum + gold (“g/t 2PGE+Au”) from surface, incl. 2 m grading 11.96 g/t 2PGE+Au from 1 m – Trado® hole AD24BV05;

Rock Assay PGE Results

- 21.32 g/t 2PGE+Au – Rock sample 103822;

- 18.89 g/t 2PGE+Au – Rock sample 102967;

- 11.44 g/t 2PGE+Au – Rock sample 103823;

- 4.54 g/t 2PGE+Au – Rock sample 103701.

Boa Vista Target

The Boa Vista target lies within the southeastern limb of the Troia unit, which represents one of the most underexplored areas of the 51,096 ha Pedra Branca PGE property. This trend also hosts the Synform target, located approximately 20 km from Boa Vista. ValOre’s previous Trado® auger and rock assay programs at Synform defined high-grade PGE mineralization, including rock assay results of up to 15 g/t 2PGE+Au and Trado assays of up to 10m grading 2.30 g/t 2PGE+Au, incl. 2 m grading 9.47 g/t 2PGE+Au (see News Release dated March 23, 2023).

At Boa Vista, ValOre conducted geological reconnaissance, prospecting and initial Trado® drilling around the historical rock sample 82701, which yielded a 15.02 g/t 2PGE+Au, with results reported herein extending known PGE mineralization to approximately 100 m in strike-length. Detailed geological mapping and Trado® drilling are planned to further investigate these high-grade results.

Table 1: Trado® Auger Assay Highlights for Boa Vista (reported herein) and Synform (reported March 23, 2023).

| Target | Hole ID | From (m) | To (m) | Length (m)1 | 2PGE+Au (g/t) | 2PGE+Au Interval Summary | News Release |

| Boa Vista | AD24BV04 | 0.00 | 4.00 | 4.00 | 0.46 | 4 m grading 0.46 g/t 2PGE+Au from 0 m | This release |

| AD24BV05 | 0.00 | 5.00 | 5.00 | 6.58 | 5 m grading 6.58 g/t 2PGE+Au from 0 m incl. 2 m grading 11.96 g/t 2PGE+Au from 2 m |

||

| 1.00 | 3.00 | 2.00 | 11.96 | ||||

| AD24BV08 | 0.00 | 5.00 | 5.00 | 0.21 | 5 m grading 0.21 g/t 2PGE+Au from 0 m | ||

| Synform | AD23SY02 | 0.00 | 10.00 | 10.00 | 2.30 | 10 m grading 2.30 g/t 2PGE+Au from surface incl. 2 m grading 9.47 g/t 2PGE+Au from surface |

March 23, 2023 |

| 0.00 | 2.00 | 2.00 | 9.47 | ||||

| AD23SY03 | 0.00 | 8.00 | 8.00 | 0.64 | 8 m grading 0.64 g/t 2PGE+Au from surface incl. 2 m grading 1.44 g/t 2PGE+Au from surface |

||

| 0.00 | 2.00 | 2.00 | 1.44 | ||||

| AD23SY04 | 0.00 | 2.00 | 2.00 | 0.33 | 2 m grading 0.33 2PGE+Au from surface | ||

| AD23SY06 | 2.00 | 3.00 | 1.00 | 0.38 | 1 m grading 0.38 2PGE+Au from 2 m | ||

| AD23SY07 | 0.00 | 1.00 | 1.00 | 0.35 | 1 m grading 0.35 2PGE+Au from surface | ||

| AD23SY08 | 0.00 | 1.00 | 1.00 | 0.17 | 1 m grading 0.17 g/t 2PGE+Au from surface and 3 m grading 0.22 g/t 2PGE+Au from 6 m |

||

| 6.00 | 9.00 | 3.00 | 0.22 | ||||

| AD23SY09 | 0.00 | 1.00 | 1.00 | 0.16 | 1 m grading 0.16 g/t 2PGE+Au from surface |

1Trado assay interval lengths are estimated to represent 90-100% of true width. Trado® end of hole (“EOH”) depths typically represent that the auger has entered impenetrable unweathered bedrock, so mineralization and ultramafic rocks (“UM”) present at EOH remain open at depth and require follow-up diamond or RC drilling.

Figure 1: Location map of the Boa Vista and Synform targets.

Figure 2: Chromitite Trado® “core” recovered from Trado® hole AD24BV05.

Quality Assurance/Quality Control (“QA/QC”)

CLICK HERE for a summary of ValOre’s policies and procedures related to QA/QC and grade interval reporting.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Thiago Diniz, P.Geo., ValOre’s QP and Vice President of Exploration.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a team aiming to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration and innovation.

ValOre’s Pedra Branca Platinum Group Elements Project comprises 45 exploration licenses covering a total area of 51,096 hectares (126,260 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au. ValOre’s team believes the Pedra Branca project has significant exploration discovery and resource expansion potential. (CLICK HERE to download 2022 technical report* and CLICK HERE for news release dated March 24, 2022).

*The 2022 Technical Report is entitled “Independent Technical Report –Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil” was prepared as a National Instrument 43-101 Technical Report on behalf of ValOre Metals Corp. with an effective date of March 08, 2022. The 2022 Technical Report by Independent qualified persons, Fábio Valério (P.Geo.) and Porfirio Cabaleiro (P.Eng.), of GE21, commissioned to complete the mineral resource estimate while Chris Kaye of Mine and Quarry Engineering Services Inc. (MQes), was commissioned to review the metallurgical information. The Mineral Resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical, plus economic and mining parameters appropriate to the deposit. Mineral Resources, which are not mineral reserves, do not have demonstrated economic viability, and may be materially affected by environmental, permitting, legal, marketing, and other relevant issues. Mineral Resources are based upon a cut-off grade of 0.4 g/t PGE+Au, correlated to Pd_eq grade of 0.35 g/t, and were limited by an economic pit built in Geovia Whittle 4.3 software and following the geometric and economic parameters as disclosed in the 2022 NI 43-101 Technical Report,

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.646.4527, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.