On May 28, 2019, ValOre announced a transaction to acquire 100% ownership of the Pedra Branca PGE District in north-eastern Brazil. A maiden NI 43-101 compliant inferred resource estimate of 1,067,000 ounces PGE+Au in 27.2 million tonnes grading 1.22 grams PGE+Au per tonne was calculated by ValOre at the time of the acquisition in 2019.

On March 24, 2022, ValOre announced the doubling of ValOre’s Pedra Branca inferred mineral resource estimate, which was expanded to 2,198,000 ounces (“oz”) palladium + platinum + gold (“2PGE+Au”) in 63,568,000 tonnes (“t”) grading 1.08 g/t 2PGE+Au. Several of the zones which form part of the resource estimate remain wide open for expansion in future drill programs.

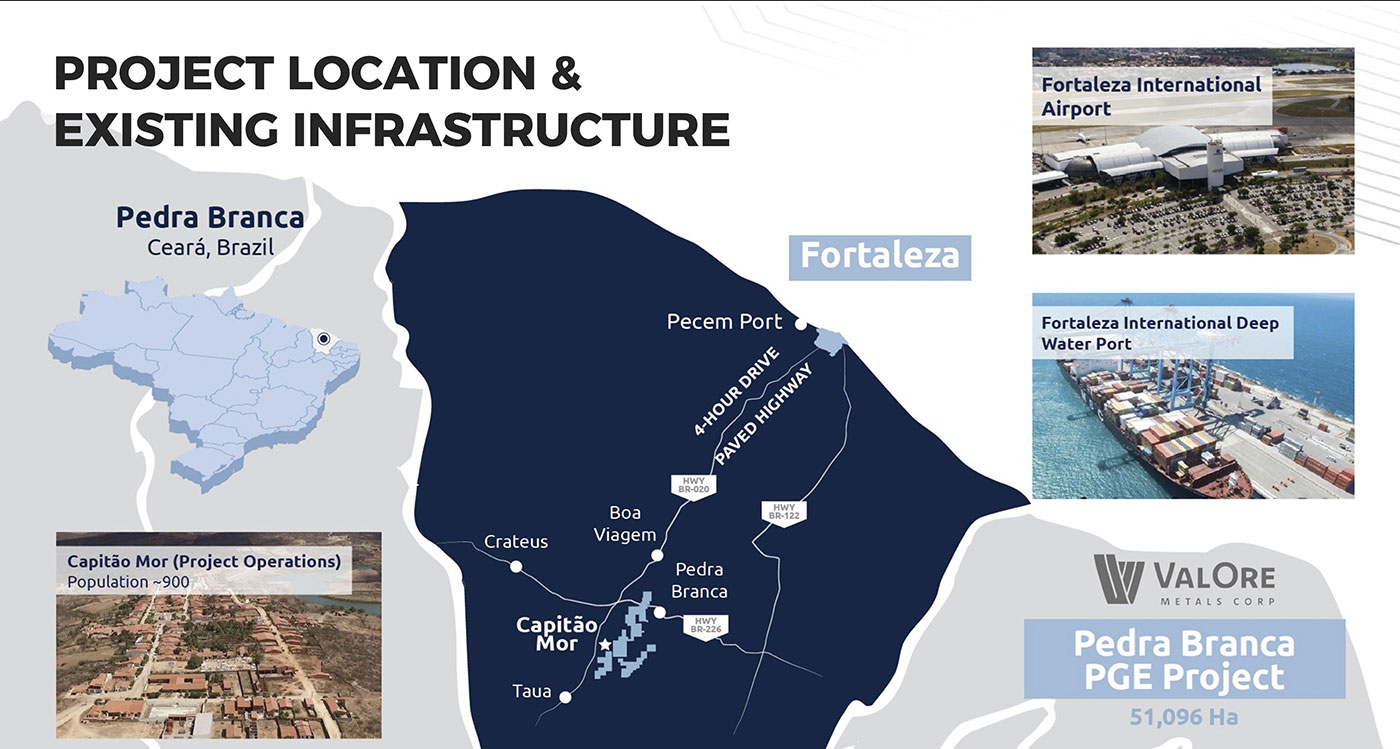

The Pedra Branca landholdings total 51,096 hectares and host 7 distinct PGE+Au deposit areas. PGE mineralization outcrops at surface, making all the inferred resources represent open pit targets, and excellent opportunities exist for resource expansion and conversion at multiple zones, including Massapê, Santo Amaro, Trapia, and Cedro. ValOre’s team has drilled 17,434 metres (“m”) since the 2019 resource (acquisition), with approximately 11,500 m allocated to resource expansion drilling. ValOre’s technical team has demonstrated the ability to expand known resource zones and to convert exploration targets into resource ounces in a very cost effective manner. The Company spent $6.1M CAD on exploration, administration and development at Pedra Branca from the 2019 acquisition and resource estimate until the updated resource announcement in March 2022. This equates to under $6 CAD (<$4.80 USD) per ounce of 2PGE+Au added to the resource inventory.

Previously, Pedra Branca was subject to over US$35M of historic exploration expenditures by Anglo American Platinum and other companies, amassing over 30,000 m of drilling, extensive geochemistry, geological mapping, and high-quality airborne + ground geophysics. Targeting methodology is proven and effective, with the ability to constrain exploration signatures of the known PGE deposits and apply the ore deposit “fingerprints” property-wide. Over 20 exploration targets have been generated, and numerous additional untested anomalies exist throughout the district.

This area of Brazil is an exploration- and mining-friendly jurisdiction, and the project is supported by the local and state governments. Access is excellent year-round, and infrastructure is in place, including electricity, water, housing, office space, core storage and logging facilities, telephone access and internet.

The exploration potential of the Pedra Branca Project from both a resource expansion and greenfields perspective is highly compelling, with numerous property-wide surface to near-surface, PGE targets. This acquisition meets ValOre’s criteria in three key areas: high-value metal mineralization on a large scale; substantial project investments by previous operators; and obvious exploration strategies and process improvements which can be implemented by ValOre to add significant value to the project.

Salvador 2PGE+Au Target Overview - From Concept to Discovery