ValOre Update of Hatchet Lake Uranium Project

Vancouver, B.C. – May 29, 2024 – ValOre Metals Corp. (“ValOre”, or the “Company”) (TSX-V: VO, OTCQB: KVLQF, Frankfurt: KEQ0) today provided an update regarding its Hatchet Lake Uranium Property.

Jim Paterson, Chairman and CEO, ValOre Metals Corp. stated: “We have partnered with knowledgeable investors with significant experience in Canada’s uranium exploration sector to help unlock value from our highly prospective Hatchet Lake Uranium Project in northeastern Saskatchewan. The timing is right to resume exploration activities at this strategically located uranium project with the backing of long-term uranium investors.”

Background to the Hatchet Uranium Corp. Transaction

ValOre incorporated Hatchet Uranium Corp. (“HUC”), pursuant to the Business Corporations Act (British Columbia), as a wholly-owned subsidiary of ValOre.

ValOre, HUC and Beaconsfield Ventures Ltd. (“Beaconsfield”) have entered into a framework agreement (the “Framework Agreement”) pursuant to which: (i) ValOre agreed to transfer its 100% undivided interest in six mineral claims located adjacent to the north-eastern margin of the Athabasca Basin in Saskatchewan, such claims being all of ValOre’s interest in the Hatchet Lake Uranium Property, to HUC in exchange for 7,500,000 common shares of HUC (“HUC Shares”) at a deemed price of $0.10 per share (the “Hatchet Lake Contribution”), and (ii) Beaconsfield subscribed for 2,500,000 HUC Shares at a price of $0.10 per share for aggregate gross proceeds to HUC of $250,000 (the “Beaconsfield Financing”). Closing of the Hatchet Lake Contribution and the Beaconsfield Financing occurred on February 28, 2024.

Following the Hatchet Lake Contribution and the Beaconsfield Financing, HUC completed a charitable, non-brokered private placement offering of 1,111,112 flow-through shares of HUC (each a “HUC Flow-Through Share”) to purchasers at a price of $0.45 per share for aggregate gross proceeds to HUC of approximately $500,000 (the “Charitable Flow-Through Offering”). Closing of the Charitable Flow-Through Offering was completed on May 14, 2024. Immediately following completion of the Charitable Flow-Through Offering, ValOre held 7,500,001 HUC Shares representing approximately 67.5% of the issued and outstanding HUC Shares.

HUC intends to use the proceeds from the Beaconsfield Financing for general working capital purposes and the gross proceeds from the Charitable Flow-Through Offering will be specifically used for “flow-through critical mineral mining expenditures” (as defined in the Income Tax Act (Canada)) on the Hatchet Lake Uranium Property located in Saskatchewan (the “Qualifying Expenditures”), which will be renounced to the purchasers of the HUC Flow-Through Shares with an effective date no later than December 31, 2024.

Proposed Hatchet Lake Uranium Property Exploration Program Highlights

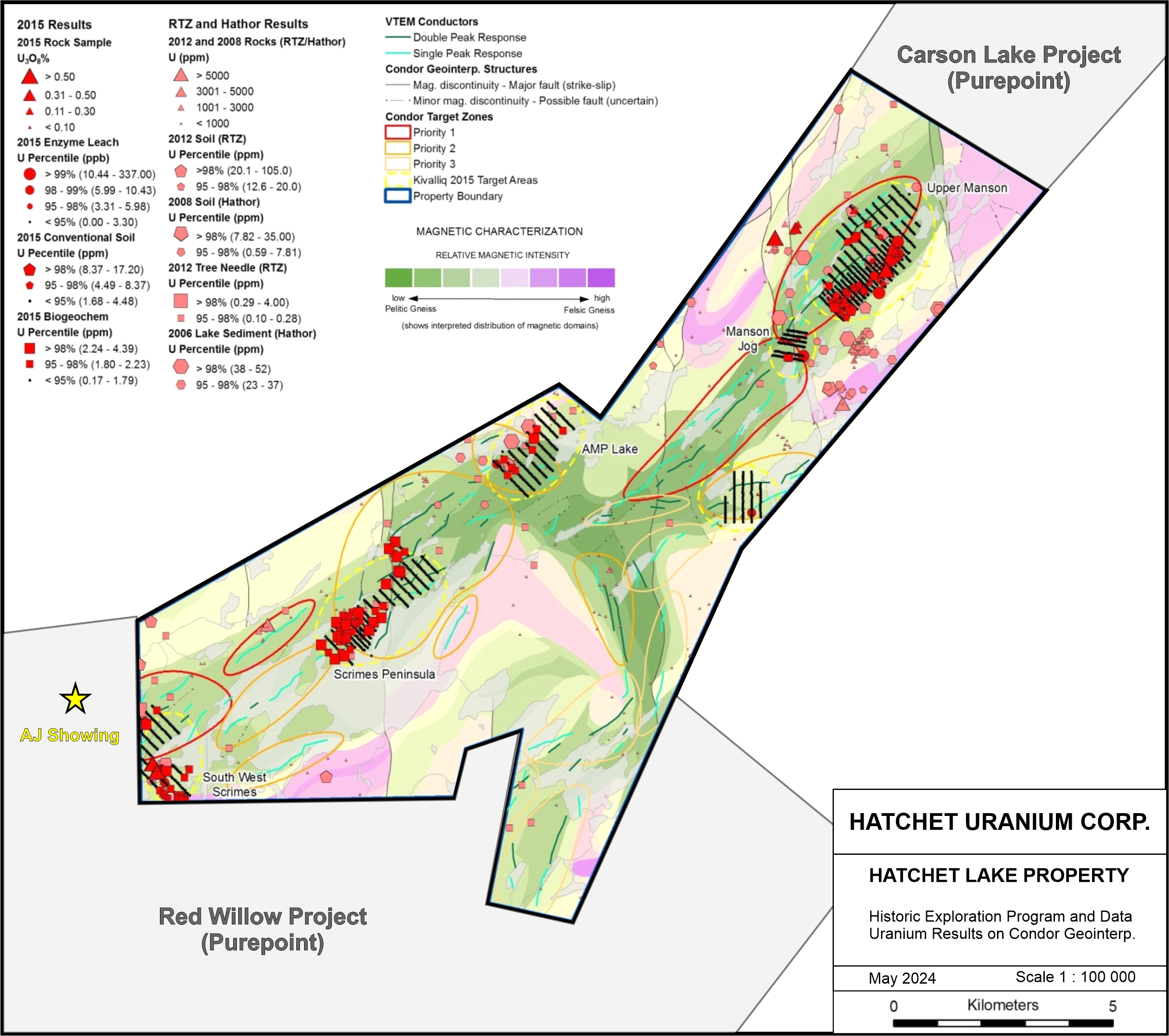

The proposed Hatchet Lake Uranium Property exploration program will initially focus on continued exploration of two high-priority zones, the Upper Manson and SW Scrimes. This work will follow up on historical uranium anomalies and mineralization noted in samples collected from float boulders, lake sediments, soils and vegetation, including 2015 grab assay results of up to 2.43% U3O8 at SW Scrimes (CLICK HERE for ValOre news release dated October 15, 2015).

In addition, data from ground magnetic and Very Low Frequency Electromagnetic (“VLF-EM”) surveys have defined multiple VLF-EM conductors that remain to be tested property wide, including the Upper Manson and SW Scrimes strike extensions.

The initial exploration program contemplated includes gridded soil sampling and additional ground magnetic, VLF-EM, and induced polarization (IP) geophysical surveys, primarily targeting uranium mineralization along strike to the southwest of the Upper Manson target region and northeast of the SW Scrimes target regions. All work is planned to be completed before the end of December 2025.

SW Scrimes is located immediately east and along trend from AJ Showing (Red Willow Project) and approximately 30 km along-trend from Roughrider, Eagle Point and McClean Lake deposits.

Figure 1 - Hatchet Lake Project Property Map and Historic Exploration Results

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Thiago Diniz, P.Geo., ValOre’s QP and Vice President of Exploration.

About Hatchet Uranium Corp.

Hatchet Uranium Corp. was incorporated by ValOre on February 7, 2024. Jim Paterson, ValOre’s Chairman and Chief Executive Officer, serves as HUC’s Chief Executive Officer and sole director. HUC’s head and registered office is located at Suite 1020 - 800 West Pender Street, Vancouver, BC V6C 2V6.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX-V: VO, OTCQB: KVLQF, Frankfurt: KEQ0) is a Canadian company with a team aiming to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration and innovation.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations by email at [email protected].

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information, as defined under applicable Canadian securities laws (collectively, “forward-looking statements”). All statements other than statements of historical fact are forward-looking statements. The use of any of the words “will”, “intend”, “anticipate”, “could”, “should”, “may”, “might”, “expect”, “estimate”, “forecast”, “plan”, “potential”, “project”, “assume”, “contemplate”, “believe”, “shall”, “scheduled”, and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to HUC’s use of proceed from the Beaconsfield Financing and the Flow-Through Offering, the renouncing of the Qualifying Expenditures and the entering into of the HUC Shareholders Agreement, if at all, and the content thereof. Forward-looking statements are not guarantees of future performance, actions, or developments and are based on expectations, assumptions and other factors that management currently believes are relevant, reasonable, and appropriate in the circumstances.

Although management believes that the forward-looking statements herein are reasonable, actual results could be substantially different due to the risks and uncertainties associated with and inherent to ValOre’s business (as more particularly described in our continuous disclosure filings available under the Company’s SEDAR+ profile at www.sedarplus.ca), as well as the risk that HUC may not use the proceeds as currently intended. Actual results or events could differ materially from those contemplated in forward-looking statements. All forward-looking statements included in this news release are expressly qualified in their entirety by these cautionary statements. Readers are cautioned to not place undue reliance on forward‑looking statements. The forward-looking statements contained in this press release are made as at the date hereof and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable securities laws.