ValOre Reports Initial Trench Results at Galante East Target, Pedra Branca, including 53 m grading 0.59 g/t 2PGE+Au, 31 m grading 0.83 g/t 2PGE+Au and 4 m grading 3.86 g/t 2PGE+Au

August 3, 2022

ValOre Reports Initial Trench Results at Galante East Target, Pedra Branca, including 53 m grading 0.59 g/t 2PGE+Au, 31 m grading 0.83 g/t 2PGE+Au and 4 m grading 3.86 g/t 2PGE+Au

Vancouver, B.C. ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today announced initial trench assay results from the Galante East target (“Galante East”) at ValOre’s 100%-owned Pedra Branca Platinum Group Elements (“PGE”, “2PGE+Au”) Project (“Pedra Branca”) in northeastern Brazil.

“ValOre’s exploration team continues to successfully utilize Trado® auger drilling and trenching to identify near surface palladium-platinum mineralization at multiple targets property wide,” stated ValOre’s VP of Exploration, Colin Smith. “The trench results at Galante East confirm the presence of in-situ PGE mineralization, demonstrate potential continuity of target chromite-bearing ultramafic rocks over 2.5 km of trend, and warrant follow-up testing in future drill programs.”

Galante East Trenching Highlights:

Assays have been received for 6 of 7 trenches, with all 6 trenches returning PGE mineralization, including:

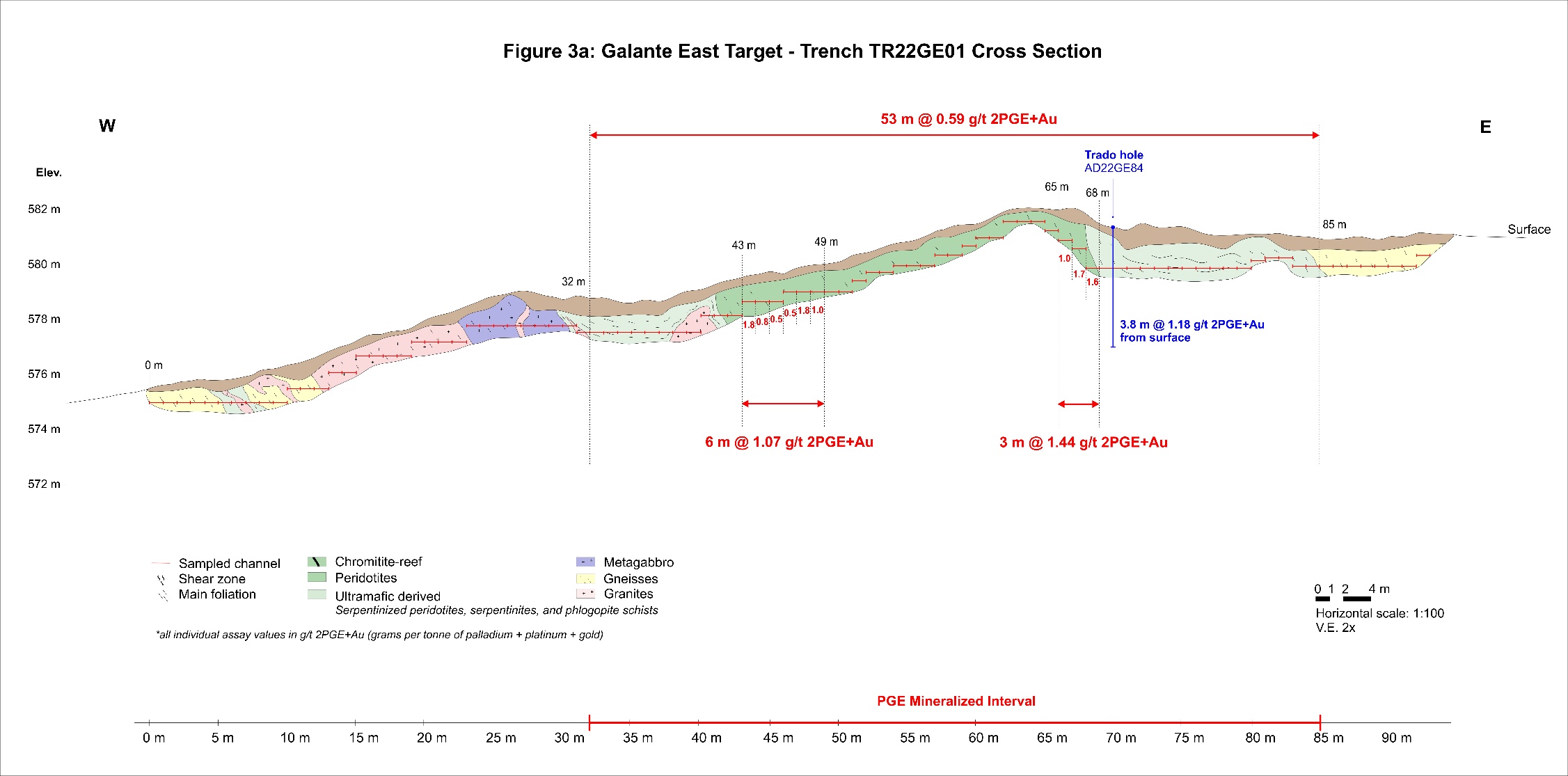

- 53 metres (“m”) grading 0.59 grams per tonne palladium + platinum + gold (“g/t 2PGE+Au”), including 6 m grading 1.07 g/t 2PGE+Au and 3 m grading 1.44 g/t 2PGE+Au in trench TR22GE01;

- 31 m grading 0.83 g/t 2PGE+Au, including 16 m grading 1.39 g/t 2PGE+Au and 4 m grading 3.86 g/t 2PGE+Au in trench TR22GE02;

- 19 m grading 0.54 g/t 2PGE+Au including 2 m grading 1.40 g/t 2PGE+Au in TR22GE05.

Assays are pending for the southernmost trench, TR22GE07, which intercepted 90 m of ultramafic and ultramafic-derived rocks ("UM” and “UM-derived”).

Galante East 2022 Exploration Program

The Galante East target is a 3-km-long prospective geological corridor located 7 km south-southwest of Santo Amaro (153,000 oz 2PGE+Au grading 1.11 g/t in 4.3 Mt), and 10 km north-northeast of Curiu (150,000 oz 2PGE+Au grading 2.20 g/t in 2.1 Mt).

Previously reported reconnaissance mapping and prospecting, soil sampling and Trado® auger programs served to corroborate and refine the historically mapped target UM intrusions and associated PGE mineralization, and supported the completion of a 2022 trenching program to further advance this undrilled 3-km-long trend. (CLICK HERE for news release dated May 2, 2022 and CLICK HERE for news release dated June 23, 2022). See Figure 1 below for a plan map of Galante East.

Detailed mapping and sampling were performed at seven trenches excavated at the Galante East target (471 metres in total length), with target UM intrusions intercepted in all 7 trenches, and initial PGE assays reported in this release for 6 of 7 trenches (TR22GE01 to TR22GE06). Assays are pending for trench TR22GE07. See Table 1 below for a summary of trench assays received to date, Figure 2 for photographs, and Figures 3a-3b for cross sections of trenches TR22GE01 and TR22GE02.

Table 1: Trench assays reported to date for Galante East Target.

| Trench ID | From (m) |

To (m) |

*Length (m) |

2PGE+Au (g/t) |

Summary Interval |

| TR22GE01 | 32.00 | 85.00 | 53.00 | 0.59 | 53 m grading 0.59 g/t 2PGE+Au incl. 6 m grading 1.07 g/t 2PGE+Au and 3 m grading 1.44 g/t 2PGE+Au |

| 43.00 | 49.00 | 6.00 | 1.07 | ||

| 65.00 | 68.00 | 3.00 | 1.44 | ||

| TR22GE02 | 20.00 | 51.00 | 31.00 | 0.83 | 31 m grading 0.83 g/t 2PGE+Au incl. 16 m grading 1.39 g/t 2PGE+Au and 4 m grading 3.86 g/t 2PGE+Au |

| 25.00 | 41.00 | 16.00 | 1.39 | ||

| 37.00 | 41.00 | 4.00 | 3.86 | ||

| TR22GE03 | 48.00 | 59.00 | 11.00 | 0.38 | 11 m grading 0.38 g/t 2PGE+Au |

| TR22GE04 | 13.00 | 15.00 | 2.00 | 0.35 | 2 m grading 0.35 g/t 2PGE+Au and 5 m grading 0.26 g/t 2PGE+Au |

| 26.00 | 31.00 | 5.00 | 0.26 | ||

| TR22GE05 | 15.00 | 34.00 | 19.00 | 0.54 | 19 m grading 0.54 g/t 2PGE+Au incl. 2 m grading 1.40 g/t 2PGE+Au |

| 21.00 | 23.00 | 2.00 | 1.40 | ||

| TR22GE06 | 3.00 | 22.00 | 19.00 | 0.31 | 19 m grading 0.31 g/t 2PGE+Au and 2 m grading 0.25 g/t 2PGE+Au |

| 36.00 | 38.00 | 2.00 | 0.25 |

*Reported trench assay interval lengths are channel samples and estimated to represent 70-80% true width

Figure 1: Plan map of Galante East, highlighting 2022 trenches along the main mineralized trends.

Figure 2: Photographs from trenching at Galante East (A and B), and a chromite-rich peridotite sample (C) collected at trench TR22GE01 from an interval assaying 1.07 g/t 2PGE+Au over 6 m.

Figure 3a: Trench TR22GE01 cross section, Galante East, highlighting geology, assays, and proximal Trado® auger drilling.

Figure 3b: Trench TR22GE02 cross section, Galante East, highlighting geology and assays.

About the Trado® Auger and Trenching methodology

CLICK HERE for more information regarding Trado® Auger and Trenching methodology

Quality Control/Quality Assurance (“QA/QC”) and Grade Interval Reporting

CLICK HERE for a summary of ValOre’s policies and procedures related to QA/QC and grade interval reporting.

Qualified Person (QP)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au (CLICK HERE for news release dated March 24, 2022). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.