ValOre Announces Commencement of 2022 Exploration at Angilak Property Uranium Project

April 7, 2022

Vancouver, B.C. ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today announced the commencement of a board approved and fully funded CAD$11 million exploration program at ValOre’s 100% owned 59,483-hectare Angilak Property Uranium Project (“Angilak”), located in Nunavut Territory, Canada.

ValOre’s Chairman & CEO, Jim Paterson, stated: “Angilak represents a world-class advanced uranium exploration project with compelling resource expansion and regional discovery potential. The Lac 50 inferred resource represents Canada’s highest grade uranium deposit outside of the Athabasca Basin and one of the highest-grade uranium resources on a global basis. Importantly, Nunavut Territory, Canada is an active and supportive mining jurisdiction, hosting the producing Meadowbank and Meliadine gold mines (Agnico Eagle) and the recently permitted Goose Mine at the Back River project (Sabina).”

ValOre’s Vice President Exploration, Colin Smith, stated: “CAD$85M of historical expenditures at Angilak, CAD$55M of that by ValOre between 2009 – 2016, served to generate the Lac 50 resource estimate, which is supported by 335 drill holes (60,258 m). The substantial prior investment will be fully leveraged in 2022, with this year’s comprehensive program designed to further demonstrate and rapidly advance the district-scale resource potential of this prolific uranium, base and precious metals property with ~8,000 m of project-wide drilling, ~2,400 ln-km of ground VLF-EM and magnetics, and multi-faceted geochemistry programs.”

Angilak Property Uranium Project 2022 Exploration Program Highlights:

- Mobilization of crews, consumables, and equipment commenced March 23;

- Initial 4,000 metre (“m”) Reverse Circulation (“RC”) drill program to commence by April 15, with a focus of expanding known zones of U3O8 mineralization;

- Geophysical program of 2,400-line-kilometres (“ln-km”) of ground VLF-EM and magnetics to commence by April 15;

- Geochemical sampling (1,000+ samples) including Enzyme Leach (“EL”) soils, rock sampling and lake sediment sampling to vector future exploration efforts;

- Baseline environmental and archaeology studies;

- Initial 4,000 m diamond drilling to commence in the summer, with a focus on resource expansion and following up positive RC drill results.

Lac 50 Trend NI 43-101 Inferred Resource Estimate

The Lac Trend (“Lac 50”) inferred mineral resource estimate comprises 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds (“Mlbs”) of U3O8. The resource estimate is supported by 335 drill holes (60,258 m) and represents Canada’s highest grade uranium deposit outside of the Athabasca Basin and one of the highest-grade uranium resources on a global basis. In addition to uranium, the Lac 50 Trend resource also contains significant quantities of silver, molybdenum and copper, and is interpreted as a basement hosted, vein-hydrothermal type, unconformity-associated uranium deposit. CLICK HERE for a summary table of the 2013 Lac 50 inferred resource estimate.

Lac 50 Metallurgical Work

In 2012 and 2013, the Saskatchewan Research Council (“SRC”) and TOMRA Sorting Inc. (“TOMRA”) conducted metallurgical and beneficiation testing respectively on Lac 50 Trend uranium mineralization. Optimized results from alkaline leaching indicate that 94.1% of uranium can be extracted in 48 hours and 95.9% of uranium extracted in 72 hours. Furthermore, the final yellowcake produced from a conventional preliminary precipitation test of the alkaline leach solution was low in impurities (below penalty levels), with a 71.9% uranium value attained.

Ore characterization testing carried out by TOMRA on a suite of high grade, medium grade, low grade and waste specimens demonstrated excellent sensor based sortability, with 96.7% cumulative uranium recovery in a mass recovery of 49.2% (i.e. 50.8% of the rock mass is rejected with a 3.3% loss of uranium). The testing reflects the high-grade uranium characteristics at Lac 50 where most of the uranium mineralization occurs as disseminations and veins of massive pitchblende within the carbonate and hematite alteration zone comprising the Lac 50 Trend inferred resource.

District-Scale, High-Grade, Near-Surface Potential

Angilak represents a world-class advanced uranium exploration project with considerable upside potential in a largely underexplored district. Exploration tenements are strategically staked around the margin of the Proterozoic Angikuni sedimentary sub-basin, enabling ValOre geologists to target the high-grade uraniferous structures from surface. In the case of Lac 50, mineralization has been traced by drilling from surface to a vertical depth of approximately 380 m and along a strike length of over 6 km, with mineralization occurring as southwest plunging shoots within the plane of a tuff unit.

Comprehensive exploration programs continue to demonstrate the district-scale potential of Angilak, as evidenced by the drilling discovery at the Dipole Trend, situated 30 km west-southwest of Lac 50, and on the opposing side of the Angikuni sub-basin. U3O8, mineralization was intercepted in all nine 2015 core holes, and included highlight hole 15-DP-009 which returned 2.34% U3O8, 1.13% Mo and 44 g/t Ag over 1.3 m from 28.3 m to 29.6 m, within a wider 3.5 m interval that assayed 0.88% U3O8, 0.46% Mo and 17.6 g/t Ag, and 6.7 m of 0.21% U3O8 from 46.4 m to 53.1 m. Dipole will be the first target tested in the spring 2022 RC drill program.

A total of 300 historical drill holes are situated outside the Lac 50 Trend: of these holes, 230 holes (77%) returned anomalous radioactivity, with counts per second (“CPS”) values above 200, and 171 holes (57%) returned CPS values above 1000.

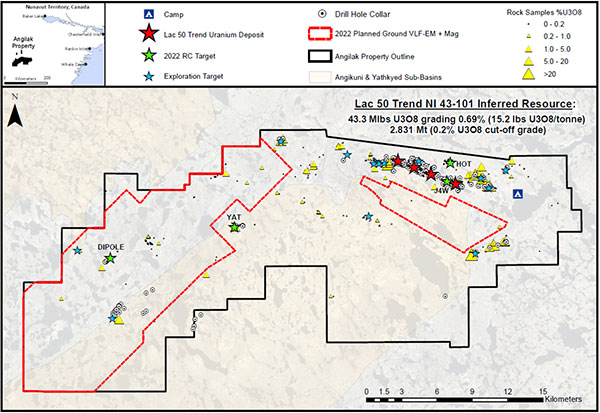

Evidence of high-grade, near-surface uranium mineralization is further demonstrated across the property by the presence of extensive historical rock samples, including 50 samples >1% U3O8, 18 samples >5% U3O8, and 8 samples >20% U3O8 (Figure 1).

Ground VLF-EM

Uranium mineralization at Angilak is structurally controlled (vein-hydrothermal type), and thus the identification of these prospective uraniferous corridors is a critical component of the exploration methodology. Ground VLF-EM has proven to be the most effective geophysical technique to delineate prospective structures property-wide, as evidenced by the ~230 km2 (2,320 ln-kms) of historical coverage. The Lac 50 Trend (and most targets) are spatially associated to moderate to strong VLF-EM conductors, which are interpreted to be mapping graphite-chlorite-sulphide (and uranium) bearing structures.

An extensive ground VLF-EM and magnetics program is planned due to commence by mid-April. The proposed survey comprises approximately 2,400 ln-kms, with a dominant focus on the sparsely covered western half of the property which hosts several priority exploration targets, and over 40 km of highly prospective geological strike along trend from Lac 50 (Figure 1).

Geochemistry

Surficial geochemistry serves to identify the prospective sections of mineralized structures and supports more targeted follow-up initiative such as trenching and drilling. The historical database includes: 4,180 EL soils, 763 conventional soils, 583 rock samples, and 1,152 lake sediment samples.

ValOre will be expanding Angilak’s surficial geochemical coverage in 2022, with additional property wide EL soils, rocks and lake sampling, to commence in July once the snow and ice have melted. Program totals are dependent on results of both the RC and ground geophysics programs.

The 2022 lake sampling program is comprised of a 70-sample orientation survey (35 samples over Lac 50, and 35 samples over a presumed background area), analyzing multiple sample mediums (lake bottom sediments, lake water and off-gases from lake sediments), and multiple uranium pathfinder analytes (helium, radon, ICP-MS major and trace elements). The most effective technique(s) will be identified and considered for a property-wide program in 2023 to further amplify Angilak’s district-scale potential. Helium and radon are both continuously produced from the decay of uranium, and thus provide a potential pathfinder for remote detection of uranium deposits, and light hydrocarbon gases (C1 to C4) have been found in world class uranium deposits like Cigar Lake.

Figure 1: Regional map of Angilak Property.

About Angilak

The 59,483-hectare Angilak Property is situated in the mining- and exploration-friendly Nunavut Territory, Canada, and has district-scale potential for uranium, precious and base metals. Since acquisition, ValOre has invested over CAD$55 million on resource delineation and exploration drilling (89,572 metres in 589 drill holes), metallurgy, geophysics, geochemistry, and logistics across the large land package. This work supported the development of the significant Lac 50 Trend NI 43-101 inferred resource estimate (“Lac 50”).

The Lac 50 NI 43-101 Technical Report (effective date March 1, 2013) defined an inferred resource estimate which represents Canada’s highest-grade uranium resource outside of Saskatchewan, and one of highest-grade uranium resources on a global basis. Highlights include:

- 43.3 Mlbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8. CLICK HERE for a summary table of the Lac 50 Trend inferred resource estimate;

- Supported by 351 resource delineation drill holes totaling 62,023 metres (“m”);

- Metallurgical results for Lac 50 demonstrate high uranium recoveries and rapid leach kinetics. See news releases: February 28, 2013, September 11, 2013 and February 27, 2014;

- Lac 50 Trend is a 15 kilometre (“km”) by 3 km area with excellent potential for resource growth and new discoveries;

- Uranium mineralization starts at surface, and has been drilled to 380 m vertical depth;

CLICK HERE for ValOre’s May 6, 2021 video summarizing the highlights of Angilak.

CLICK HERE for ValOre’s May 6, 2021 video reviewing the 2021 focus for Angilak.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

Information in this presentation related to the independent Angilak mineral resource estimate has been approved by Michael Dufresne, M.Sc. P.Geo., President of Apex Geoscience Ltd., Robert Sim, P.Geo. of SIM Geological Inc. and Bruce Davis, FAusIMM of BD Resources Consulting Inc., who are independent QPs as defined under NI 43‐101.

Susan Lomas, P.Geo., of LGGC is the QP, as defined in NI 43-101, responsible for the Pedra Branca mineral resource estimates as reported below.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au (CLICK HERE for news release dated March 24, 2022). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities./p>