ValOre Identifies High-Priority Targets for Fully Funded 2022 Exploration Program at Angilak Property

November 29, 2021

Vancouver, B.C. ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today provided an exploration update for ValOre’s 100%-owned Angilak Property Uranium Project (“Angilak”), located in Nunavut Territory, Canada.

“The potential for significant resource expansion and discovery at Angilak is exceptional, including 14 targets with high-grade U3O8 drill intercepts which span 60 kilometres of underexplored prospective geological trend,” stated ValOre’s Vice President Exploration, Colin Smith. “ValOre is preparing a multi-faceted and fully funded 2022 exploration program to rapidly expand and advance the project, supported by the recently-closed and oversubscribed C$11M financing.”

Angilak Uranium Project 2021 Targeting Highlights

The 2022 Angilak exploration program will comprise a multi-faceted campaign including: core drilling, Enzyme Leach (“EL”) soil sampling, ground geophysics including ground magnetics and VLF-EM, and district-wide prospecting, mapping, and sampling. A property-wide targeting review has identified high-priority targets to be advanced in a fully funded 2022 exploration program, characterized into 3 target classes:

- Lac 50 Trend Resource Expansion: 4 targets adjacent or contiguous to inferred resource zones;

- Target Advancement: 10 targets to follow-up ValOre U3O8 drill intercepts at zones not included in the inferred mineral resource;

- New Discovery: 20 targets which merit drilling.

Complete geophysical and geochemical datasets have been re-processed, re-interpreted and re-integrated into the Angilak geological and targeting model. In addition, 466 square kilometres (46,600 hectares) of new WorldView spectral data and high-spatial resolution imagery covers 100% of the high-priority targets and prospective basin-margin. Key areas along two major trends have been identified for completion of ground magnetics, VLF-EM and EL geochemical sampling.

ValOre has closed a C$11M financing to support a significant exploration program at Angilak in 2022 (CLICK HERE for news release dated November 17, 2021).

Targets to Drive Significant Resource Expansion and Future Discoveries

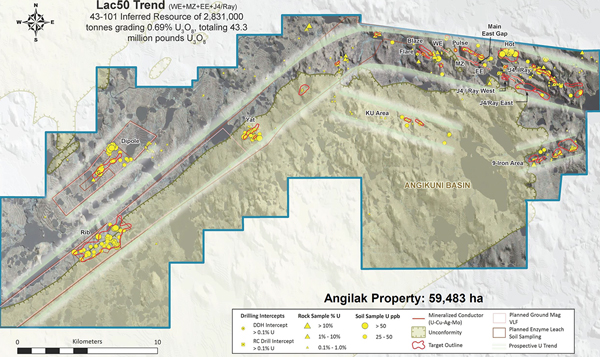

Angilak is a world-class advanced uranium exploration project with tremendous upside potential in a vastly underexplored district. The on-going property-wide targeting review has identified 34 targets to date, which are characterized into 3 classes: Resource Expansion, Target Advancement (ValOre-drilled high-grade U3O8 intercepts at pre-resource targets), and New Discovery (targets undrilled by ValOre). See Figure 1 below for a regional map of the Angilak Property, summarizing the locations and classes of the 34 targets reported herein, and the extent of additional planned ground magnetic and VLF-EM surveys and EL soil sampling.

Figure 1: Regional Plan Map of Angilak Property

Lac 50 Resource Expansion

The 2013 Lac 50 inferred mineral resource comprises 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds (“Mlbs”) of U3O8, representing Canada’s highest grade uranium deposit outside of the Athabasca Basin. In addition to uranium, the Lac 50 Trend contains significant quantities of silver, molybdenum and copper as outlined in the resource, and is interpreted as a basement hosted, vein-hydrothermal type, unconformity-associated uranium deposit. CLICK HERE for a summary table of the Lac 50 inferred resource estimate.

Lac 50 hosts significant resource expansion potential, with multiple high-grade U3O8 extension targets remaining wide open. Mineralization occurs as southwest plunging shoots, which have been traced by drilling to a maximum vertical depth of approximately 380 metres (“m”) and along a strike length of over 6 kilometres (“km”).

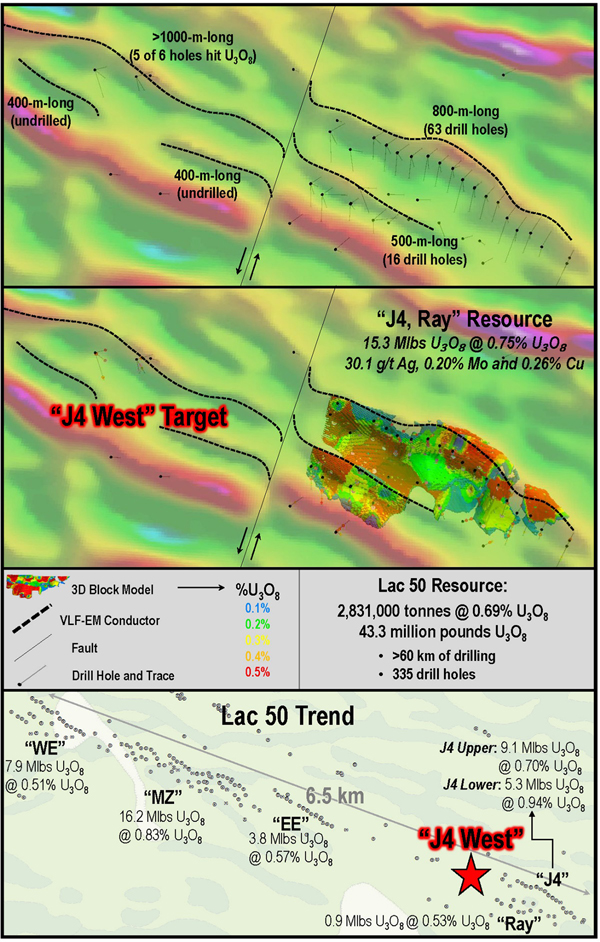

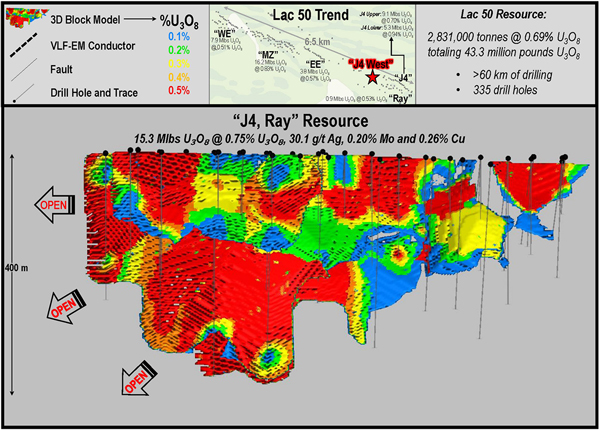

Resource Expansion Target (J4 West - Example)

Lac 50’s J4 Zone (“J4”) contributes 15.3 Mlbs of U₃O₈ grading 0.75% U₃O₈, 30.1 g/t Ag, 0.20% Mo and 0.26% Cu to the overall Lac 50 Trend resource. J4 remains entirely open down-plunge, and the re-processed ground VLF-EM data highlights a distinct off-set and interpreted continuation of the uranium-rich conductor immediately to the east-southeast of the resource zone. See Figures 2 and 3 below for a plan maps and 3D cross sections of J4, showing the fully open high-grade U₃O₈ shoots at depth, and the potential for continuation of the J4 and Ray zones along their interpreted fault offset to the west.

Similar resource upside has also been identified at Lac 50’s Eastern Extension (“EE”), Western Extension (‘WE”) and Main Zone (“MZ”), all of which will be considered for targeted expansion drilling.

Figure 2: Plan Map of J4 and Ray Resource Zones, and J4 West Resource Expansion Target

Figure 3: Cross Section of J4 and Ray Resource Zones, and J4 West Resource Expansion Target

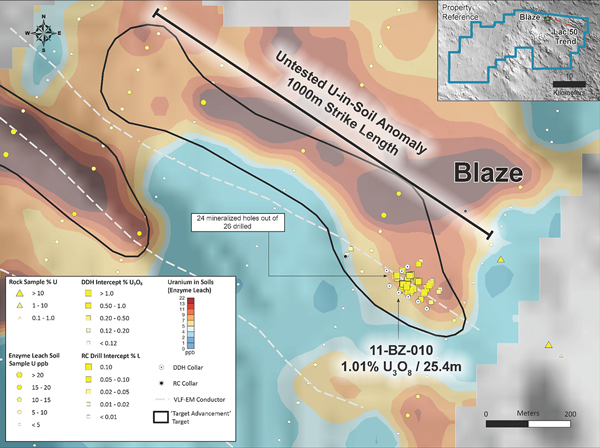

Target Advancement (Blaze - Example)

The Blaze Target (Figure 4) is located approximately 2 km west of the Lac 50 Trend. Mineralization occurs as complex pitchblende veins and disseminated sulphides in quartz-carbonate veins and breccia. The Blaze Target has been drilled across a strike length of 100 m, with significant mineralization intersected between 30 and 126 m depth below surface. A total of 3,466 m in 24 drill holes drilled in 2010 and 2011 investigated mineralization at Blaze. The most notable Blaze drill hole is 11-BZ-010 assaying 1.01% U₃O₈ over 25.4 m. Subsequent drill holes suggest the true width of this intercept to be roughly 4 m. Blaze is untested by drilling for at least 1000 m to the west-northwest along a strongly anomalous uranium-in-soils trend (EL) and related to a 600 m VLF-EM conductor.

Figure 4: Plan Map of Blaze Target

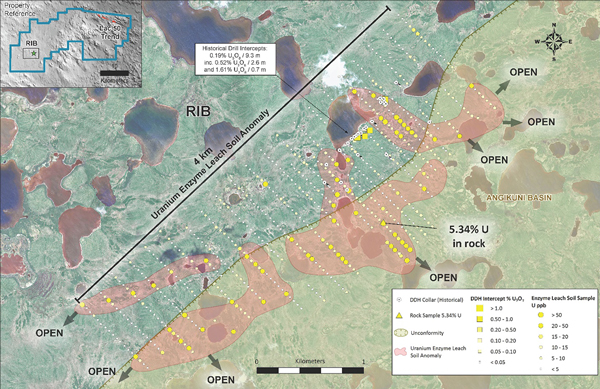

New Discovery Target (RIB - Example)

The RIB target (Figure 5) was identified as a basement conductor by Noranda Exploration Ltd. in 1976. During 1977-78, 14 of 25 diamond drill holes over a 1.2-km trend intersected uranium mineralization at shallow depths (less than 35 m), with the two best intercepts being 0.19% U3O8 over 9.3 m, including 0.52% U3O8 over 2.6 m and 1.61% U3O8 over 0.7 m. Exploration by ValOre in 2014 confirmed the RIB conductor using airborne VTEM geophysics. EL soil samples also outlined a corresponding 4-km-long uranium geochemical trend extending northeast, southwest and south of the historic Noranda drilling. Cobbles discovered south of the historic Noranda drilling near the anomalous EL soil geochemical samples assayed 5.34% U and lie on a parallel geophysical conductive trend approximately 500 m southeast of the conductor tested by the Noranda drilling. Planned ground magnetic and VLF-EM coverage will assist in better correlating the EL uranium anomalies with specific conductor targets prior to drilling.

Figure 5: Plan Map of RIB Target

About Angilak

The 59,483-hectare Angilak Property is situated in the mining- and exploration-friendly Nunavut Territory, Canada, and has district-scale potential for uranium, precious and base metals. Since acquisition, ValOre has invested over C$55 million on resource delineation and exploration drilling (89,572 metres in 589 drill holes), metallurgy, geophysics, geochemistry, and logistics across the large land package. This work supported the development of the significant Lac 50 Trend NI 43-101 inferred resource estimate (“Lac 50”).

The Lac 50 NI 43-101 Technical Report (effective date March 1, 2013) defined an inferred resource estimate which represents Canada’s highest-grade uranium resource outside of Saskatchewan, and one of highest-grade uranium resources on a global basis. Highlights include:

- 43.3 Mlbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8. CLICK HERE for a summary table of the Lac 50 Trend inferred resource estimate;

- Supported by 351 resource delineation drill holes totaling 62,023 metres (“m”);

- Metallurgical results for Lac 50 demonstrate high uranium recoveries and rapid leach kinetics. See news releases: February 28, 2013, September 11, 2013 and February 27, 2014;

- Lac 50 Trend is a 15 kilometre (“km”) by 3 km area with excellent potential for resource growth and new discoveries;

- Uranium mineralization starts at surface, and has been drilled to 380 m vertical depth;

CLICK HERE for ValOre’s May 6, 2021 video summarizing the highlights of Angilak.

CLICK HERE for ValOre’s May 6, 2021 video reviewing the 2021 focus for Angilak.

About WorldView Spectral Data

CLICK HERE for ValOre’s summary of WorldView spectral data, and CLICK HERE for additional information from DigitalGlobe™ on the Hi-Res WV-3 orbiting system.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

Information in this presentation related to the independent Angilak mineral resource estimate has been approved by Michael Dufresne, M.Sc. P.Geo., President of Apex Geoscience Ltd., Robert Sim, P.Geo. of SIM Geological Inc. and Bruce Davis, FAusIMM of BD Resources Consulting Inc., who are independent QPs as defined under NI 43‐101.

Susan Lomas, P.Geo., of LGGC is the QP, as defined in NI 43-101, responsible for the Pedra Branca mineral resource estimates as reported below.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to complement its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 51 exploration licenses covering a total area of 55,984 hectares (138,339 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a current Inferred Resource of 1,067,000 ounces 2PGE+Au contained in 27.2 million tonnes grading 1.22 g/t 2PGE+Au (CLICK HERE for ValOre’s July 23, 2019 news release). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. *For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.