ValOre Drills 21 m at 1.67 g/t 2PGE+Au from 27 m at Massapê and 22 m at 1.40 g/t 2PGE+Au from 13 m at Santo Amaro South, Pedra Branca

December 20, 2021

Vancouver, B.C. ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) reports core drilling assay results from the Massapê and Santo Amaro South targets at ValOre’s 100%-owned Pedra Branca Platinum Group Elements (“PGE”, “2PGE+Au”) Project (“Pedra Branca”) in northeastern Brazil.

“ValOre’s proven exploration methodology has led to exciting near-surface 2021 drilling results at both Massapê and Santo Amaro South,” stated ValOre’s VP of Exploration, Colin Smith. “Both targets will be considered in the resource update planned for Q1 2022 and remain wide open for expansion with further drilling.”

Massapê Zone 2021 Drilling Highlights:

- 11 core holes drilled totaling 1,510 metres (“m”), with all 11 intercepting the target PGE-bearing ultramafic (“UM”) intrusion;

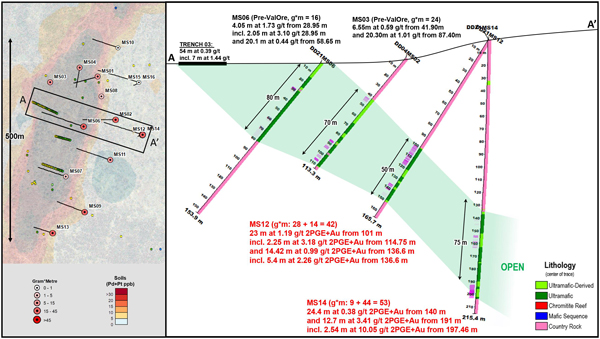

- PGE intervals returned in 10 of 11 core holes, with highlights including:

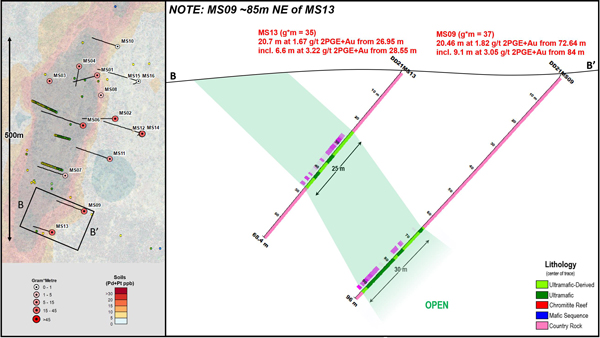

- 21 m at 1.82 grams per tonne palladium + platinum + gold (“g/t 2PGE+Au”) from 73 metres (“m”), incl. 9.1 m at 3.0 g/t 2PGE+Au from 84 m in drill hole DD21MS09

- 21 m at 1.67 g/t 2PGE+Au from 27 m, incl. 6.6 m at 3.22 g/t 2PGE+Au from 29 m in drill hole DD21MS13

- 23 m at 1.19 g/t 2PGE+Au from 101 m, and 14 m at 0.99 g/t 2PGE+Au from 137 m incl. 5.4 m at 2.26 g/t 2PGE+Au from 136.6 m in drill hole DD21MS12;

- Drill-confirmed PGE mineralization established along a 400 m trend: open along strike to the south, and at depth to the east.

Santo Amaro South Zone 2021 Drilling Highlights:

- 4 holes drilled totaling 300 m, with all 4 intercepting the target PGE-bearing UM intrusion, including the following highlights:

- 22 m at 1.40 g/t 2PGE+Au from 13 m in drill hole DD21SAS05

- 18 m at 1.46 g/t 2PGE+Au from 51 m, incl. 9.8 m at 2.42 g/t 2PGE+Au from 58 m in drill hole DD21SAS04

- 13 m at 1.29 g/t 2PGE+Au from 69 m in drill hole DD21SAS07;

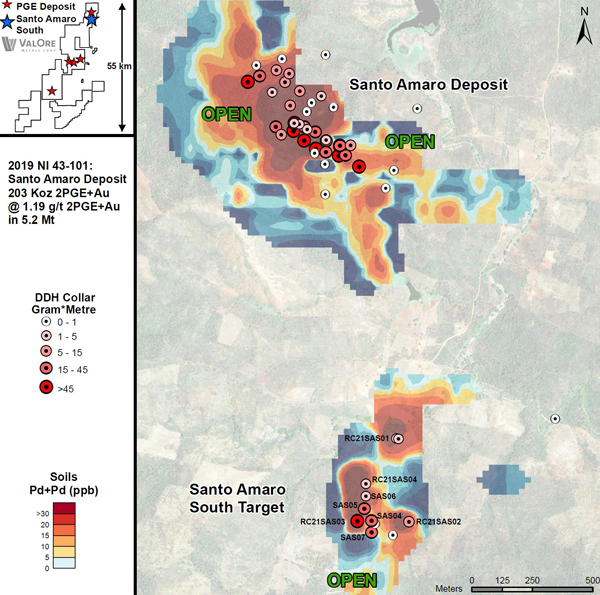

- Drill-confirmed PGE mineralization established along a 200 m trend that is open in all directions.

*Reported core assay interval lengths are estimated to represent 90-100% of true width

The Massapê Zone is situated four kilometres (“km”) along trend to the north of the Trapia deposit area (218,000 oz at 1.11 g/t 2PGE+Au in 6.1 Mt), and the Santo Amaro South target is situated 1 km due south of the Santo Amaro deposit area (203,000 oz at 1.19 g/t 2PGE+Au in 5.3 Mt). Both Massapê and Santo Amaro South are underexplored and highly prospective PGE-bearing zones that were not included in ValOre’s 2019 NI 43-101 Pedra Branca inferred resource (1,067,000 oz at 1.22 g/t 2PGE in 27.2 Mt). Please refer to the Summary Table of the 2019 Inferred Resource and Pedra Branca Resource Estimate NI 43-101 Technical Report, May 2019.

2021 Massapê Zone Drilling

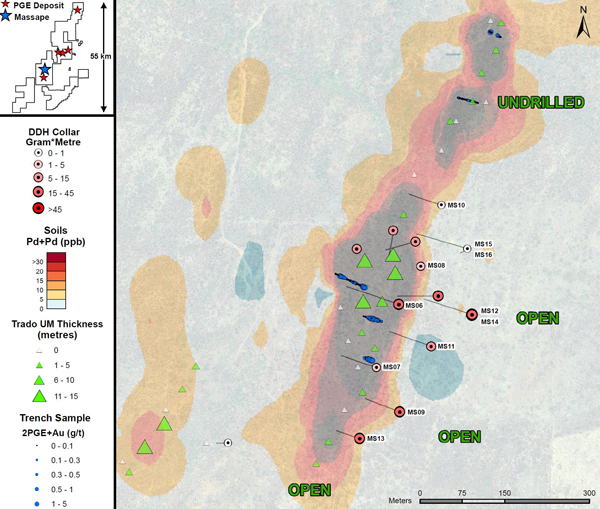

During 2021, the Massapê target was rapidly advanced to a high priority drill target by ValOre’s sequential exploration methodology, which included detailed geological mapping, Trado® auger drilling, and trenching (CLICK HERE for news release dated August 26, 2021).

Drilling in 2021 intercepted the target UM intrusion in all 11 core holes over 450 m of geological trend. PGE-bearing Trado® auger hole samples have been collected along strike to the north and south of 2021 core drilling, establishing a prospective strike length of ~1 km to be further tested in 2022. See Table 1 for a summary of significant core assay results, and Figures 1-3 below.

2021 Santo Amaro South Zone Drilling

ValOre’s exploration methodology quickly established the Santo Amaro South Zone as a high-quality drill target in 2021 (CLICK HERE for news release dated March 23, 2021). This lead to a Reverse Circulation (“RC”) drilling discovery of 32 m at 1.65 g/t 2PGE+Au from surface in drill hole RC21SAS03 (CLICK HERE for news release dated August 23, 2021), and the drilling of 4 follow-up core holes, all of which intercepted the shallow PGE-bearing UM intrusion. PGE mineralization remains open in all directions, and is to be further tested in 2022. See Table 1 for a summary of significant core assay results, and Figure 4 below.

Table 1: Significant Core 2PGE+Au Assays from 2021 Massapê and Santo Amaro Drilling

| Target | Hole ID | From (m) |

To (m) |

Length (m) |

Au (g/t) |

Pd (g/t) |

Pt (g/t) |

2PGE+Au (g/t) |

Summary Interval | Zone Gram x metre |

Total Gram x metre |

| Massapê | DD21MS06 | 28.95 | 33 | 4.05 | 0.02 | 1.21 | 0.51 | 1.73 | 4.0 m at 1.73 g/t 2PGE+Au from 29 m incl. 2.0 m at 3.10 g/t 2PGE+Au from 29 and 20 m at 0.44 g/t 2PGE+Au from 59 m |

7 | 16 |

| 28.95 | 31 | 2.05 | 0.02 | 2.11 | 0.96 | 3.10 | |||||

| 58.65 | 78.75 | 20.1 | 0.03 | 0.28 | 0.12 | 0.44 | 9 | ||||

| Massapê | DD21MS07 | 14 | 28 | 14 | 0.01 | 0.09 | 0.04 | 0.13 | 14 m at 0.13 g/t 2PGE+Au from 14 m incl. 6.0 m at 0.21 g/t 2PGE+Au from 22 m |

2 | 2 |

| 22 | 28 | 6 | 0.01 | 0.13 | 0.07 | 0.21 | |||||

| Massapê | DD21MS08 | 53.65 | 60 | 6.35 | 0.02 | 0.26 | 0.13 | 0.41 | 6.4 m at 0.41 g/t 2PGE+Au from 54 m | 3 | 3 |

| Massapê | DD21MS09 | 66.80 | 93.1 | 26.3 | 0.03 | 1.10 | 0.31 | 1.45 | 26 m at 1.45 g/t 2PGE+Au from 67 m incl. 9.1 m at 3.05 g/t 2PGE+Au from 84 m |

38 | 38 |

| 84 | 93.1 | 9.1 | 0.05 | 2.38 | 0.62 | 3.05 | |||||

| Massapê | DD21MS10 | 20.2 | 21 | 0.8 | 0.01 | 0.38 | 0.19 | 0.58 | 0.8 m at 0.58 g/t 2PGE+Au from 20 m | 1 | 1 |

| Massapê | DD21MS11 | 85 | 108.65 | 23.65 | 0.01 | 0.15 | 0.09 | 0.25 | 24 m at 0.25 g/t 2PGE+Au from 85 m incl. 2.0 m at 0.41 g/t 2PGE+Au from 89 m and 5.7 m at 0.61 g/t 2PGE+Au from 103 m |

6 | 6 |

| 89 | 91 | 2 | 0.01 | 0.21 | 0.20 | 0.41 | |||||

| 103 | 108.65 | 5.65 | 0.01 | 0.41 | 0.19 | 0.61 | |||||

| Massapê | DD21MS12 | 101 | 124 | 23 | 0.03 | 0.63 | 0.52 | 1.19 | 23 m at 1.19 g/t 2PGE+Au from 101 m incl. 2.3 m at 3.18 g/t 2PGE+Au from 115 m and 14 m at 0.99 g/t 2PGE+Au from 137 m incl. 5.4 m at 2.26 g/t 2PGE+Au from 137 m |

28 | 42 |

| 114.75 | 117 | 2.25 | 0.06 | 2.19 | 0.93 | 3.18 | |||||

| 136.6 | 151.02 | 14.42 | 0.01 | 0.77 | 0.21 | 0.99 | 14 | ||||

| 136.6 | 142 | 5.4 | 0.02 | 1.80 | 0.45 | 2.26 | |||||

| Massapê | DD21MS13 | 26.95 | 47.65 | 20.70 | 0.02 | 1.27 | 0.37 | 1.67 | 21 m at 1.67 g/t 2PGE+Au from 27 m incl. 6.6 m at 3.22 g/t 2PGE+Au from 29 m |

35 | 35 |

| 28.55 | 35.15 | 6.60 | 0.04 | 2.20 | 0.60 | 2.84 | |||||

| Massapê | DD21MS14 | 140 | 164.4 | 24.4 | 0.01 | 0.24 | 0.12 | 0.38 | 24 m at 0.38 g/t 2PGE+Au from 140 m and 13 m at 3.41 g/t 2PGE+Au from 191 m incl. 2.5 m at 10.05 g/t 2PGE+Au from 197 m |

9 | 53 |

| 191 | 203.7 | 12.7 | 0.02 | 2.84 | 0.55 | 3.41 | 44 | ||||

| 197.46 | 200 | 2.54 | 0.04 | 8.93 | 1.07 | 10.05 | |||||

| Massapê | DD21MS16 | 130.95 | 148 | 17.05 | 0.01 | 0.19 | 0.06 | 0.26 | 17 m at 0.26 g/t 2PGE+Au from 131 m | 4 | 4 |

| Santo Amaro South | DD21SAS04 | 51 | 69.2 | 18.2 | 0.02 | 0.81 | 0.63 | 1.46 | 18 m at 1.46 g/t 2PGE+Au from 51 m incl. 9.8 m at 2.42 g/t 2PGE+Au from 58 m incl. 3.6 m at 4.22 g/t 2PGE+Au from 64 m |

27 | 27 |

| 57.75 | 67.55 | 9.8 | 0.03 | 1.30 | 1.09 | 2.42 | |||||

| 64 | 67.55 | 3.55 | 0.06 | 2.16 | 1.99 | 4.22 | |||||

| Santo Amaro South | DD21SAS05 | 12.6 | 34.15 | 21.55 | 0.01 | 0.88 | 0.52 | 1.40 | 22 m at 1.40 g/t 2PGE+Au from 13 m | 30 | 30 |

| Santo Amaro South | DD21SAS06 | 17.95 | 23.7 | 5.75 | 0.01 | 0.28 | 0.13 | 0.42 | 5.8 m at 0.42 g/t 2PGE+Au from 18 m incl. 2.1 m at 0.85 g/t 2PGE+Au from 22 m |

2 | 2 |

| 21.65 | 23.7 | 2.05 | 0.01 | 0.60 | 0.23 | 0.85 | |||||

| Santo Amaro South | DD21SAS07 | 68.7 | 81.52 | 12.82 | 0.02 | 0.82 | 0.46 | 1.29 | 13 m at 1.29 g/t 2PGE+Au from 68.7 m incl. 9.8 m at 1.47 g/t 2PGE+Au from 71 m incl. 3.4 m at 2.13 g/t 2PGE+Au from 77 m |

17 | 17 |

| 71.2 | 80.97 | 9.77 | 0.02 | 0.94 | 0.52 | 1.47 | |||||

| 77 | 80.35 | 3.35 | 0.03 | 1.19 | 0.92 | 2.13 |

*Reported core assay interval lengths are estimated to represent 90-100% true width

Figure 1: Plan Map of at Massapê Target

Figure 2: Cross Section A-A’, Massapê Target

Figure 3: Cross Section B-B’, Massapê Target

Figure 4: Plan Map of Santo Amaro South Target and Santo Amaro Deposit

Quality Control/Quality Assurance (“QA/QC”) and Grade Interval Reporting

CLICK HERE for a summary of ValOre’s policies and procedures related to QA/QC and grade interval reporting.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

Disclosure Related to Finders Fees Paid on Offering

The Company also announced that further to its press release dated November 17, 2021 regarding the closing of the previously announced "best efforts" brokered private placement (the "Offering") for gross proceeds of C$11,000,000, in addition to the fees paid to Red Cloud Securities Inc. as agent, the Company paid an aggregate of $83,420 and issued an aggregate of 139,033 non-transferable finder's warrants (the "Finder's Warrants") to certain arm's-length finders in connection with their entitlement to receive 6% cash commission and 6% Finder's Warrants for subscribers introduced by such finders. Each Finder's Warrant entitles the holder to acquire one common share of the Company at a price of C$0.60 at any time on or before November 17, 2023.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 51 exploration licenses covering a total area of 55,984 hectares (138,339 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a current Inferred Resource of 1,067,000 ounces 2PGE+Au contained in 27.2 million tonnes grading 1.22 g/t 2PGE+Au (CLICK HERE for ValOre’s July 23, 2019 news release). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.