ValOre Reports Rhodium Assays from Pedra Branca PGE Project, Brazil: Initial results from Esbarro Deposit yield up to 1.44 g/t Rhodium.

March 12, 2020

Vancouver, B.C. ValOre Metals Corp. (TSX‐V: VO) ("ValOre") today announced initial rhodium (Rh) assay results for 51 historical, pulverized drill core samples (pulps) from the Pedra Branca Platinum Group Elements and Gold (PGE+Au) project in northeastern Brazil. This is the first-time rhodium has been assayed in drill core at Pedra Branca.

Key Point Summary:

- Rhodium is a rare and valuable platinum group metal. The spot price of which has risen dramatically over the past 18 months from below US$4,000 per ounce in mid-2019 to the current price of US$11,500;

- Rhodium mineralization has not been previously documented in drill core assays from Pedra Branca;

- A strong correlation was noted between 2PGE+Au grade (palladium + platinum + gold) and rhodium grade, with the 5 highest-grade 2PGE+Au pulps exhibiting 4 of the highest Rh assay values;

- The Esbarro deposit returned the best results, with 6 of 8 pulps over the detection limit, including the highest-grade assay of 1.44 grams Rh/tonne, and the highest average grade (0.35 g Rh/t);

- 21 of the 51 pulps (41%) collected from five deposit areas making up the global NI 43-101 2PGE+Au inferred resource returned rhodium values over detection limit (0.01 g Rh/t).

ValOre’s Chairman and CEO, Jim Paterson stated: “Rhodium was previously undocumented in drilling related data at Pedra Branca; however, with these results we can see the correlation between the higher grades of palladium, platinum and rhodium in drill core and our team is excited to utilize this knowledge to help us in the exploration and discovery process on a regional scale.”

Fifty-one (51) historical Pedra Branca drill core pulp samples were submitted for rhodium assay at SGS Geosol, Minas Gerais. Batches of approximately 10 pulps from each of the existing five NI 43-101 PGE+Au deposits were selected on the following basis: a range of 2PGE+Au grades (from >2 to >44 g/t) and intercept depths (from near surface to >86m) to assess trends in rhodium distribution. A strong positive correlation of Rh grade to 2PGE+Au grade was evident, with the 5 highest-grade 2PGE+Au samples returning 4 of the highest Rh values. There was no observable trend in Rh grade distribution based on drill intercept depth.

The Esbarro deposit (394,000oz at a grade of 1.23 g 2PGE+Au/t) returned the best results, with 6 of 8 pulps assaying greater than detection limits, the highest-grade Rh assay (1.44 g Rh/t), and the highest average grade (0.35 g Rh/t). The Cedro deposit (151,000oz at a grade of 1.10 g 2PGE+Au/t) performed second-best, with 6 of 11 pulps assaying over detection, and the Curiu (100,000 oz @ 1.93 g 2PGE+Au/t) and Trapia (219,000 oz @ 1.11 g 2PGE+Au/t) deposits returned 4 of 8 and 4 of 12 pulps over detection, respectively. The Santo Amaro deposit (203,000oz at a grade of 1.19 g 2PGE+Au/t) returned no assays over Rh detection limit.

Rhodium assay results (SGS Geosol, Minas Gerais) from historical Pedra Branca drill core pulps are summarized in the following table:

| Deposit | Drill Hole | Sample | Depth From (m) | Depth To (m) | Historical Pd+Pt+Au (g/t) | Rh (g/t) |

| Esbarro | DD04ES35 | 90643 | 5.60 | 6.10 | 44.24 | 1.44 |

| DD03ES15 | 89715 | 33.00 | 34.00 | 6.01 | 0.39 | |

| DD03ES31 | 90544 | 46.60 | 48.07 | 7.68 | 0.34 | |

| DD99ES05 | 89210 | 49.46 | 50.30 | 10.39 | 0.31 | |

| DD03ES11 | 89486 | 29.24 | 30.11 | 2.78 | 0.24 | |

| DD04ES35 | 90644 | 6.10 | 8.10 | 10.16 | 0.04 | |

| DD03ES21 | 90071 | 2.30 | 4.00 | 3.34 | <0.01 | |

| DD03ES31 | 90541 | 43.00 | 44.90 | 2.16 | <0.01 | |

| Cedro | DD10CD86 | 87290 | 42.41 | 43.38 | 15.75 | 1.27 |

| DD10CD89 | 87354 | 25.30 | 26.00 | 20.12 | 0.87 | |

| DD04CD18 | 91595 | 24.21 | 25.09 | 2.64 | 0.07 | |

| DD01CD04 | 90996 | 22.14 | 23.00 | 11.16 | 0.05 | |

| DD01CD03 | 90971 | 54.00 | 56.00 | 2.67 | 0.01 | |

| DD01CD05 | 91071 | 83.40 | 83.90 | 9.32 | <0.01 | |

| DD10CD89 | 87345 | 14.30 | 16.00 | 5.39 | <0.01 | |

| DD10CD79 | 87203 | 21.60 | 23.60 | 4.87 | <0.01 | |

| DD01CD05 | 91082 | 95.41 | 96.64 | 3.29 | <0.01 | |

| DD01CD05 | 91073 | 84.90 | 86.28 | 2.31 | <0.01 | |

| Trapia | DD09TU09 | 86012 | 42.81 | 43.53 | 5.76 | 0.27 |

| DD04TU04 | 92565 | 85.57 | 86.50 | 3.25 | 0.16 | |

| DD01TW10 | 92891 | 42.46 | 43.46 | 3.17 | 0.04 | |

| DD09TW16 | 86054 | 36.29 | 36.79 | 7.69 | 0.01 | |

| DD99TW03 | 92779 | 19.81 | 20.39 | 5.56 | <0.01 | |

| DD01TU03 | 92631 | 116.45 | 117.23 | 4.41 | <0.01 | |

| DD99TW01 | 92678 | 11.45 | 12.42 | 3.30 | <0.01 | |

| DD99TW07 | 92832 | 35.35 | 37.00 | 3.11 | <0.01 | |

| DD07TW12 | 82405 | 14.65 | 15.31 | 2.81 | <0.01 | |

| DD01TU02 | 92482 | 84.23 | 85.57 | 2.71 | <0.01 | |

| DD01TU02 | 92481 | 82.79 | 84.23 | 2.25 | <0.01 | |

| DD99TW04 | 92734 | 51.43 | 52.73 | 2.06 | <0.01 | |

| Curiu | DD04CU16 | 93313 | 1.74 | 3.00 | 7.89 | 0.17 |

| DD03CU13 | 93207 | 7.79 | 9.19 | 20.45 | 0.08 | |

| DD03CU10 | 93122 | 67.40 | 68.00 | 3.35 | 0.03 | |

| DD04CU15 | 93283 | 1.25 | 3.11 | 3.63 | 0.02 | |

| DD03CU12 | 93180 | 38.33 | 39.33 | 6.90 | <0.01 | |

| DD03CU10 | 93124 | 69.53 | 70.24 | 4.14 | <0.01 | |

| DD03CU12 | 93186 | 44.88 | 45.81 | 3.80 | <0.01 | |

| DD03CU11 | 93134 | 19.00 | 21.00 | 2.54 | <0.01 | |

| Santo Amaro | DD02SA02 | 93385 | 26.70 | 27.86 | 18.02 | <0.01 |

| DD04SA08 | 93532 | 109.75 | 110.25 | 8.66 | <0.01 | |

| DD02SA02 | 93386 | 27.86 | 29.70 | 6.64 | <0.01 | |

| DD02SA02 | 93393 | 39.00 | 40.40 | 3.80 | <0.01 | |

| DD04SA08 | 93544 | 132.00 | 133.20 | 3.66 | <0.01 | |

| DD02SA06 | 93601 | 55.00 | 55.58 | 2.18 | <0.01 | |

| DD02SA02 | 93387 | 29.70 | 31.00 | 2.13 | <0.01 | |

| DD02SA02 | 93433 | 87.65 | 89.15 | 2.05 | <0.01 |

Further supporting ValOre’s initial review of Rh at Pedra Branca is an independent petrographic and x-ray diffraction (XRD) study conducted by Pathor Geological Consulting Ltd. at the University of Western Ontario in September, 2019. Pathor’s research identified As-Rh-bearing mineral inclusions and Bi-Pd tellurides occurring as anhedral or stringy inclusions within rims and cores of chromite, pyrite, and pentlandite (Banerjee and Botor, 2019).

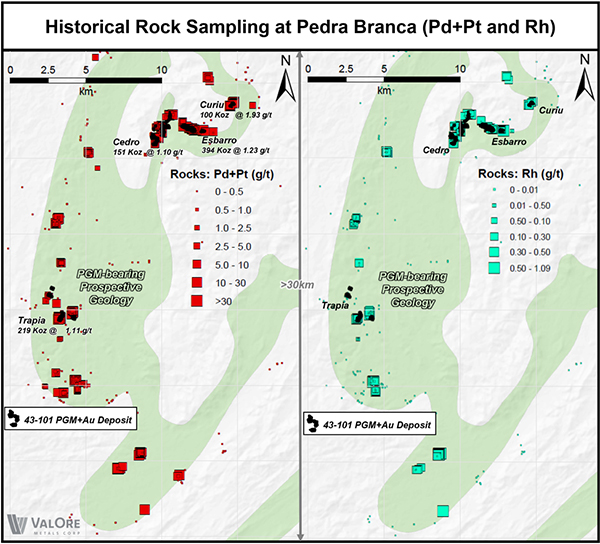

While Rh in drill core or in soils has not been previously analyzed at Pedra Branca, there are some historical rock assay datasets that reported rhodium values. The historical Rh-in-rock data exhibits the positive correlation to high-grade 2PGE+Au rock samples, as illustrated in Figure 1.

Figure 1: Rhodium-in-Rock Sampling Data in the Central Pedra Branca PGE+Au District

About Rhodium

Rhodium is the rarest of the platinum group metals, only occurring up to one part per 200 million in the Earth's crust. The main use for rhodium is in catalytic converters designed to clean vehicle emissions. Due to its brilliance and resistance to oxidation, it is also used as a finish for jewelry, LCD monitors, and mirrors. In the chemical industry it is used in the production of nitric acid, acetic acid and hydrogenation reactions. Rhodium is found in platinum and nickel ores together with the other PGEs. South Africa is the world’s largest producer of rhodium (~80%) followed by Russia (~10%), Zimbabwe (~4%), Canada and the U.S.A.

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., New Project Review, ValOre Metals Corp.

Historical Pedra Branca drill core pulps were collected from the secured core logging and storage facility located in Capitão Mór, Ceará, Brazil. Selected pulp samples were sent with an ensured chain of custody to SGS Geosol, Vespasiano, Minas Gerais (Brazil) for analysis, which is accredited mineral analysis laboratory. All pulp samples were analyzed for Rh content using standard 50g Fire Assay Atomic Absorption ICP-MS. Certified PGE ore reference standards, blanks and field duplicates were inserted as a part of ValOre’s quality control/quality assurance program (QA/QC). No QA/QC issues were noted with the results reported herein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Please visit ValOre’s website to view an updated corporate presentation and Pedra Branca project summary: http://www.valoremetals.com/investors/presentations-downloads/

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 38 exploration licenses covering a total area of 38,940 hectares (96,223 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a NI 43-101 Inferred Resource of 1,067,000 ounces 2PGE+Gold (Palladium, Platinum and Gold; Pd, Pt+Au) contained in 27.2 million tonnes (“Mt”) grading 1.22 grams 2PGE+Gold per tonne (“g 2PGE+Au/t”) (see ValOre’s July 23, 2019 news release). PGE mineralization outcrops at surface and all of the inferred resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s 89,852-hectare Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a NI 43‐101 Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. ValOre's. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please refer to ValOre's news release of March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

"Jim Paterson"

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about, ValOre Metals Corp. or this news release, please visit our website at www.valoremetals.com or contact Investor Relations toll free at 1.888.331.2269, at 604.646.4527, or by email at [email protected] .

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: www.discoverygroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of the Company and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.